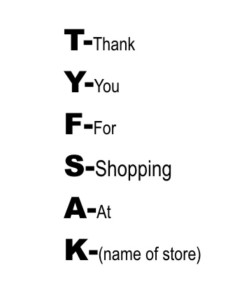

“Tyfsak” said the cashier, as she handed the customer her receipt. “Next.” The next customer in line had his wares sacked then paid the cashier. Again the cashier said, “Tyfsak.” Next in line my husband was very curious as he approached the cashier, who had a very bored, tired look. After exchanging some small talk my husband saw the memo taped near the register – “Don’t forget to say TYFSAK.” The cashier was following instructions to the letter. But was she adding the intended value to the customer’s experience?

This event happened about 15 years ago. This retail store led with innovative business ideas throughout the 1980s. Now it is struggling to keep up with its competition.

Here’s another true story:

Another business trip and another hotel, but near the hotel was a nice, well-known restaurant my husband knew by reputation. He liked the food at this particular chain and strolled over for a good dinner. As he walked in, he saw the restaurant’s mission statement on the wall behind the hostess. It read, “Our mission is to provide our customers with a high quality dining experience in a home-like atmosphere.”

The hostess was deeply involved in a good book. My husband approached the counter and stood, and continued standing for over a minute. The hostess never looked up. It must have been a very good book. He finally cleared his throat and after several more seconds the hostess finally looked up, then back down and finished the portion of her reading that the customer had so rudely interrupted. After about two minutes my husband was seated and ate a sub-par meal. This restaurant chain was also out of business in the next three years.

The following is a comment made on an article about the value of “intangibles” especially in High Performing Organizations.

“In (the) real world, employees don’t choose, they are allowed to stay. So their ‘happiness’ means nothing for a performing entity, although every system is made by people and people (have) to engage with the enterprise’s goals. I don’t (advise) anybody to invest considering ‘intangibles.’ Great, *durable* success stories are made on tangible results. All the rest is marketing for the masses.”

The idea of intangibles is about as tricky as being able to define “leadership” or to put one’s finger on “culture.”

The good news is that intangible has a precise definition. The definition from the Merriam-Webster Dictionary is: not made of physical substance, not able to be touched, not tangible.

Examples of intangible in a sentence are:

- Leadership is an intangible asset to a company.

- Electrical energy is completely intangible.

Jürgen Daum, named one of the top 100 thought leaders for Europe, has stated this about intangibles: “A corporate balance sheet, prepared according to generally-accepted accounting principles, does a reasonable job informing about the physical assets and financial capital employed by a company. But when it comes to the increasingly important intangible assets of corporate enterprises, it provides next to no insight” Juergen Daum Report

Mr. Daum breaks intangible assets into the following types:

- The value of the relationship between the company and its customers

- The value of the relationship between the company and its employees

- The value of the relationship between the company and its business partner network (suppliers).

- The value of the R&D pipeline

- The value of the company’s ability to innovate

- The value of a highly skilled, talented, committed workforce

- The value of leading-edge business processes

- The value of organization structures and corporate culture that convert individual knowledge and skills into relationship value and innovation capital

Interestingly, modern accounting has not changed much since the 1400s when Luca Pacioli, an Italian mathematician, developed double-entry bookkeeping. This method of understanding the way people were doing business and ability to track transactions was so successful that it has survived more than 600 years.

Unfortunately, the new world in which we live now is not made up only of tangible transactions. The old way of accounting cannot account for knowledge, innovation, brand loyalty, or new ways of doing business.

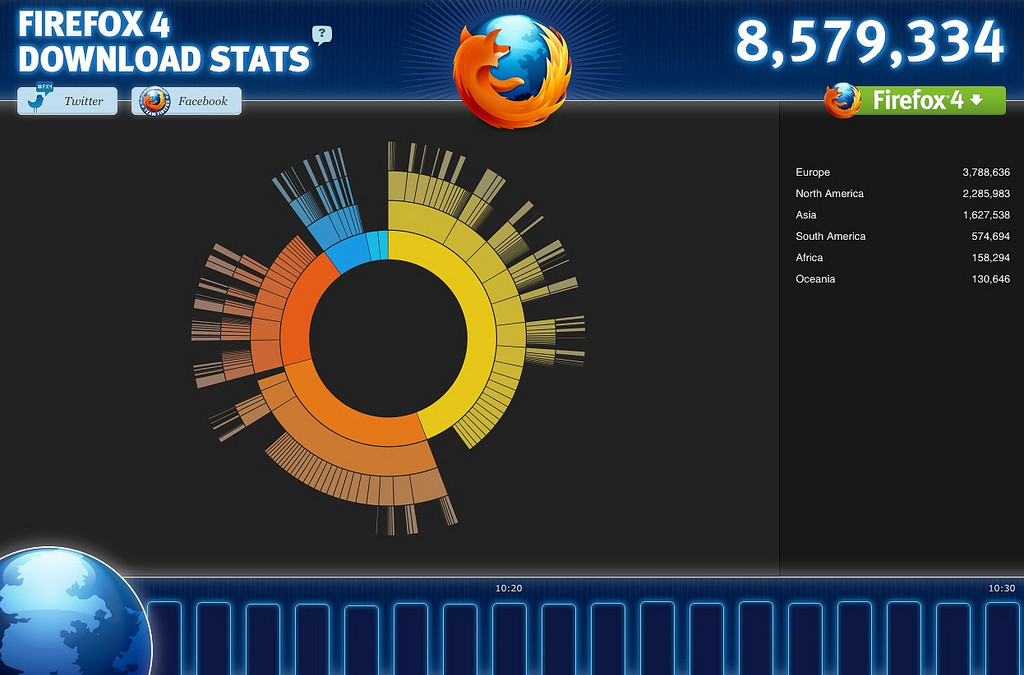

Take Mozilla as an example. Mozilla is an open source, web-based company founded in 2005. True, its profits are in the millions, not billions, like the mega-companies. But its knowledge and service are invaluable to our modern world. Most of Mozilla’s income is from partnerships (an intangible). The highest source of expense is to the knowledge-based line item, “software development” and is four times more than the marketing budget. Software development is done by highly skilled, talented, employees, who choose to work for this extraordinary company. What does Mozilla offer the world? It built the web browser Firefox and its Private Browsing feature. Mozilla associates developed educational programs and tools like Hive Learning Networks and Webmaker. Their associates number over 2,000 and their volunteers come from seven continents, and speak 80 different languages. Everyone believes in the mission: “To ensure the internet is a global public resource open and accessible to all.” Mozilla annual report

How is it possible to calculate the value of Mozilla? Everything about the company is based on intangibles, including their view of their stakeholders. Mozilla link

Mozilla is only one example of the many diversified types of industry dependent on intangibles for survival. The Ritz Carlton Hotel Company states that its business is not selling beds or food, but service. Ritz-Carlton’s motto is, “We are ladies and gentlemen serving ladies and gentlemen.”

Dave Ulrich and Norm Smallwood approach intangibles in a slightly different way. They classify key intangibles as “organizational capabilities.” Organizational capabilities, they say, emerge when a company delivers on the combined competencies and abilities of it people. HBR articl. They also are very clear that since every organization is different, the capabilities needed to make that company successful will be different. They have found that in general 11 capabilities are most common among the best managed companies.

1-Talent: Are they good at attracting, motivating, and retaining competent committed talented people?

2- Speed: Are they good at making important changes rapidly?

3- Shared Mind-Set and Brand Identity: Are they good at ensuring employees and customers have positive and consistent images and experiences with the organization?

4-Accountability: Are they good at obtaining high performance from employees?

5-Collaboration: Are they good at working across boundaries to ensure efficiency and leverage?

6-Learning: Are they good at generating and generalizing ideas?

7- Leadership: Are they good at embedding leaders throughout the organization?

8-Customer Connectivity: Are they good at building enduring relationships with their target customers?

9-Strategic Unity: Are they good at articulating and sharing a strategic point of view?

10-Innovation: Are they good at doing something new in both content and process?

11-Efficiency: Are they good at managing costs?

One more giant in the field of understanding organizations is André de Waal. For the past ten years he has analyzed data on more than 2,500 companies to determine the factors that make a high performing organization. His research confirms that companies who excel in these five factors also have superior financial results compared with their peers:

- Quality of management

- Action orientated management

- Long-term focus

- Continuous improvement & innovation

- Quality of employees

Notice that all five of these factors are intangibles.

Three different approaches (Daum, Ulrich-Smallwood, and de Waal) and three different styles of research from three different areas of expertise have all come to the same conclusion. Even though intangibles are very hard to measure, they greatly affect the bottom line of any organization. If you are interested, just follow the separate links for more information on each of the research studies.

Baruch Lev, professor of accounting and finance at New York University’s Stern School of Business, has come up with similar figures for the worth of intangibles to the bottom line. He stated in an interview, “Today, if you don’t innovate and very quickly, then you are dead. And I’m not talking just about high-tech and the Internet. Intangibles are at the center of all innovation, and they come at the beginning of the process (ideas, discoveries), in the middle (patents) and, of course, at the end (distribution channels).

The life or death of corporations is now based on innovation, which has meant a huge growth in intangibles. They were always there, but they were not such a huge part of the life of business enterprises.” For complete interview

The bottom line of this article is: to all those who feel “intangibles” are a waste of time and energy, beware – you have just proven that you are on the downward slide of the organizational lifecycle.

Tyfsak to you!

Mozilla Photo credit: <a href=”https://www.flickr.com/photos/ryansnyder/5554004481/”>Ryan Snyder</a> via <a href=”http://foter.com/”>Foter.com</a> / <a href=”http://creativecommons.org/licenses/by/2.0/”>CC BY</a>